overtime calculation in malaysia

Malaysia follows a progressive tax rate from 0 to 28. Every 5 consecutive hours followed by a rest period not less than 30 minutes.

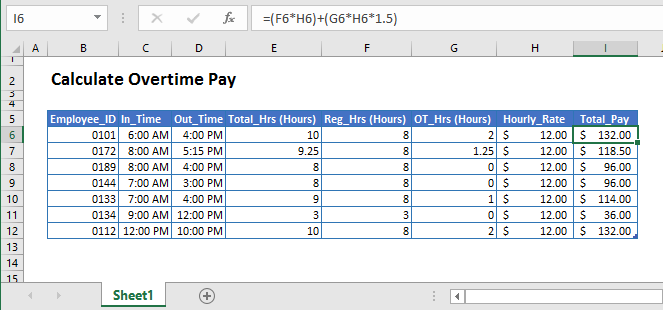

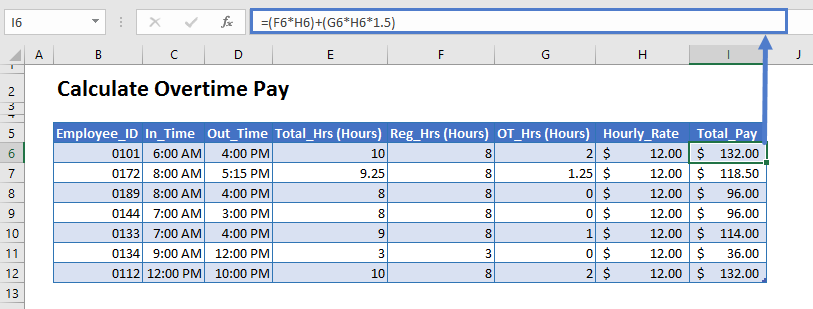

Excel Formula Basic Overtime Calculation Formula

A resident employees PCB calculation are categorised into four formulas.

. Rate Calculation Jennifer Kearns Duane Morris LLP February 17 2022 In two days the latest iteration of California Supplemental Paid Sick Leave. RM4 000 Allowance. A Better Way of Overtime Calculation.

Having different types of payment modes for your employees is not a problem as it can calculate hourly daily and monthly salaries. Aside from monthly salaries employers in Malaysia need to contribute to EPF SOCSO and EIS of their employees according to the regulations. Control Your Companys Expenses Efficiently.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Affordable Easy-to-Use and Secure. You can handle claims benefits leave calculate tax and much more.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. This best payroll software in Malaysia can handle multiple company transactions at a time. B For the purposes of the restriction on overtime under this subsection overtime shall have the meaning assigned thereto in subsection 3 b.

Example of EPF Calculator Wages 5000. For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary. Gratuity payment to employee payable at the end of a service period or upon voluntary resignation.

Therefore be aware of the overtime workers are doing and make sure youre aware of. Level 23 Nu Tower 2 KL Sentral Jalan Tun Sambanthan Kuala Lumpur 50470 Indonesia. Thamrin Boulevard Jakarta 10230.

SQL Payroll Software removes the complexities in Human Resources Management make your payroll process easier. Salary Calculation for Incomplete Month When an employee joins a company or ceases employment during a month thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. The Salary of a monthly rated employee is apportioned base on the number of days in the respective calendar month.

Overtime payments including payments for work carried out on rest days and public holidays. 6 months salary slips and bank statement are required if you want to include variable income such as overtime commissions etc in addition to fixed salary. Users can further customise the computation for allowance overtime and shift calculation with a built-in formula builder.

Overtime functionality to cater to all industries. HR2eazy payroll calculation currently is customized and set as per Malaysia. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

SQL Payroll is the only software that you would ever need to use for your Payroll. Schedule a FREE DEMO today. Another common mistake made when inputting information into the payroll check template is the incorrect calculation of overtime hours.

21 Calculation of Overtime Work. HR2eazy payroll Malaysia is the best HR Payroll software in Malaysia. The overtime calculator rate payable for non-workmen is capped at the salary level of MYR125000 and have work of 44 hours a week For overtime calculator for payroll software malaysia work your employer must pay you at least 15 times the hourly basic rate of pay.

SQL Payroll Software ready with all HR management eLeave PCB tax calculator specific contribution assignment and automatic overtime calculation. Overtime Any payment due from an employer to an employee for work carried out in excess of the normal working hours of such employee and includes any payment paid to an employee for work carried out on public. Net PCB RM 500000 x 28.

6 The Minister may make regulations for the purpose of calculating the payment. If an employee works overtime make sure to pay them the correct amount as stated in your overtime policy. In Malaysia matters concerning working hours and wages are regulated under the Employment Act 1955 and Minimum Wages Order 2016.

Calculation of EPF Calculator Malaysia 2022. Total monthly remuneration RM 500000. Certified true copy of Form 24 Shares issued and authorised share capital.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. Certified true copy of the Memorandum and Articles of Association. Pusat Bisnis Thamrin City Lt.

CALIFORNIA SUPPLEMENTAL PAID SICK LEAVE 2022. Normal working hours 1. Payment must be made within 14 days after the last day of the salary period.

1 Normal Remuneration Normal remuneration is a fixed monthly salary.

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Calculate Overtime In Excel Google Sheets Automate Excel

Calculate Overtime In Excel Google Sheets Automate Excel

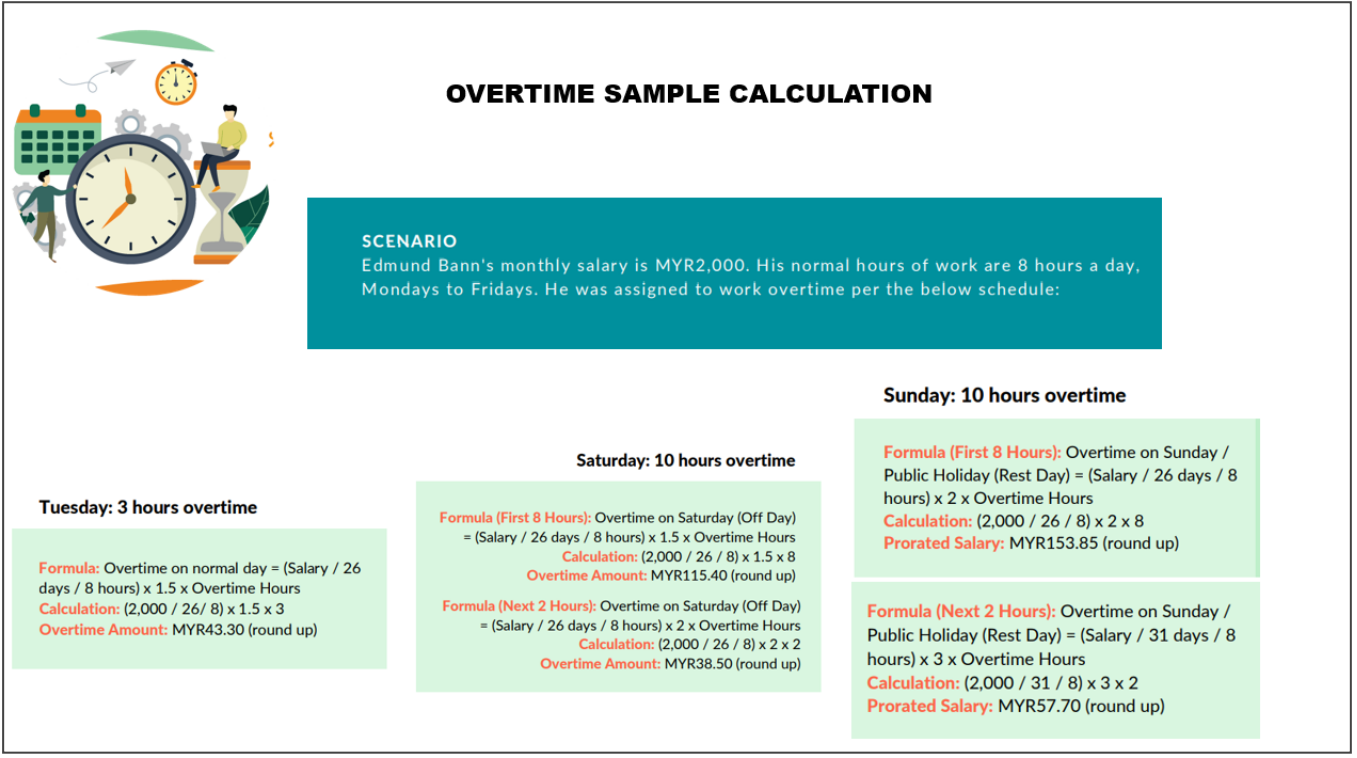

Your Step By Step Correct Guide To Calculating Overtime Pay

Excel Formula Timesheet Overtime Calculation Formula Exceljet

How To Calculate Public Holiday Pay In Malaysia

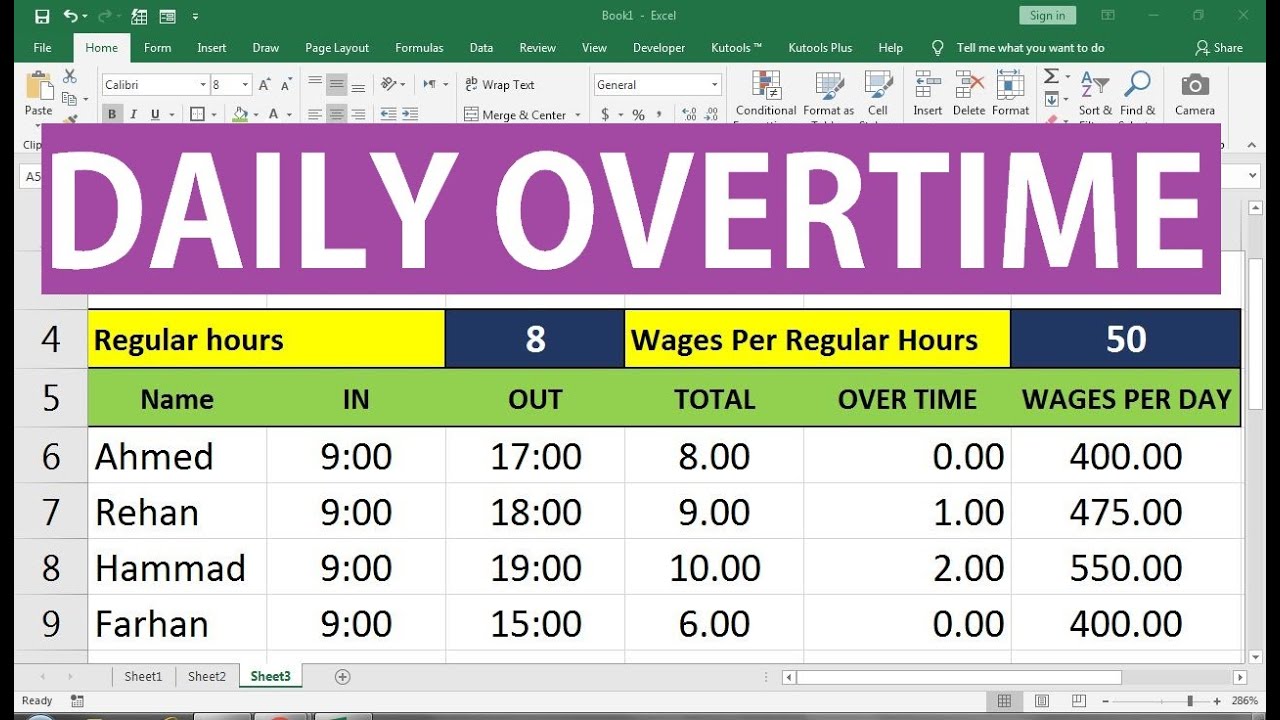

Overtime Calculation Formula In Excel Youtube

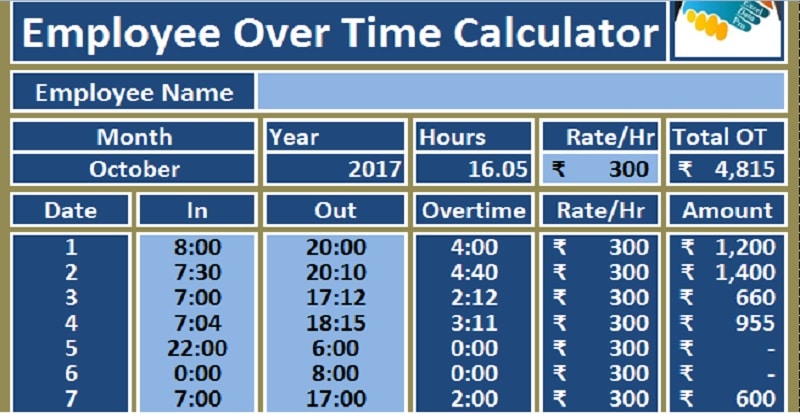

Download Employee Overtime Calculator Excel Template Exceldatapro

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Calculate Overtime In Excel Google Sheets Automate Excel

Everything You Need To Know About Running Payroll In Malaysia

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculation Dna Hr Capital Sdn Bhd

Your Step By Step Correct Guide To Calculating Overtime Pay

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

No comments for "overtime calculation in malaysia"

Post a Comment